The only treasury tech solution built for real estate.

The only treasury tech solution built for real estate.

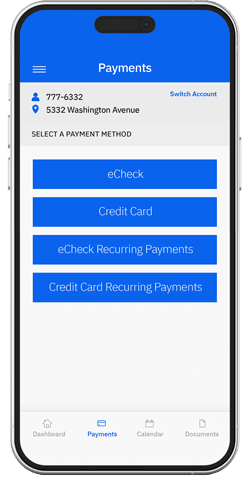

TresRE brings banking, software and payments together, solving for inefficiency, better accuracy and reliability for real estate managers nationally. As an all-in-one payment processing solution for Real Estate businesses, TresRE offers three core services: platform & software integrations, electronic payment options and a digital lockbox platform with a dedicated exception processing team.

Bank where you want, in the software you want, driven by a single solution.

TresRE integrates with numerous software providers.

Interested in becoming an integrated partner?

Contact UsProven. Trusted. Easy.

Manage banking needs in a new, secure platform, providing easy payment options for residents and integration options with a growing list of software providers.

Connect to our bank network seamlessly inside of your software.

Enable daily reconciliation and automated interest posting for reserve funds.

View and archive bank statements in your software and automatically include in monthly reporting packages.

View cleared check images.

Transfer funds at your bank and between other banks.

14 Lockbox Locations